Let’s face it: chances are, many of us aren’t money-smart.

Some of us can go through our entire lives without knowing how to make budgets work, save our earning, handle debt or even make our money grow into wealth.

Sadly, most of the education we received growing up involved practically anything except money matters. Whether this is due to the lack of appreciation of our educational institutions on financial literacy or the tendency of the academe to look down on matters of coin, this situation leaves us at a loss when it comes to financial problems.

What is money smarts?

Money smarts, otherwise known as financial literacy, refers to the knowledge and skills required to manage one’s personal finances effectively. It involves understanding how to earn, save, invest, and spend money in a way that maximizes one’s financial well-being and minimizes financial stress.

If you feel yourself lacking in any of these skills, you may need to brush up on your money smarts.

- Budgeting. Can you create a budget and stick to it? Do you understand the flow of your income and expenses and therefore know how to allocate your money accordingly?

- Saving. Can you put aside some money for short-term and long-term goals? Should a medical emergency that brings astronomical hospital bills, a major purchase such as a downpayment for a house, or sudden unemployment arise, will you have saved funds for it?

- Investing. Can you make your money grow aside from just working several jobs, thereby getting passive income? Would you know how to invest your money and manage your risks to support your goals?

- Debt Management. Would you be able to manage your debt responsibly, such as paying off high-interest debt first and avoiding unnecessary debt?

- Financial Planning. Can you plan your finances for a long-term basis taking into consideration your goals, income, and expenses? Can you plot out the steps you have to take and adjustments you need to make with how you earn, spend and save your money to be able to achieve your goals?

Why is it important to have money smarts?

Money smarts is important because it allows us to take control of our finances, bringing about these benefits:

- Financial Stability: It helps us ensure that we are living within our means and saving for our future.

- Reduced Stress. It provides us with the know-how to manage our finances effectively, eliminating guesswork and uncertainty.

- Better Financial Decisions. It allows us to make informed decisions about our money, particularly in terms of investing, saving and spending.

- Increased Wealth. It helps us increase our wealth over time through making smart financial decisions and investing in our future.

How to develop money smarts

If you find yourself lacking in money smarts, it makes sense to start developing it. The prospect may seem daunting at first, but with some dedication, you can take some steps to improve your financial knowledge and skills:

- Get in the know. Educate yourself about personal finance by reading books, attending seminars, or taking online courses about the basics of budgeting, saving, investing, and debt management.

- Start budgeting. Creating and sticking to a budget is an essential component of money smarts. Track your expenses for a month – including all expenses such as rent, utilities, food, and entertainment – and factor those into your budget.

- Set financial goals. Have a definite goal in mind to help you make smart financial decisions and stay motivated to do so while saving for a down payment on a house or paying off debt.

- Start saving today. If you haven’t already, set aside a portion of your income each month for an emergency fund or long-term savings.

- Manage your debt. Being entirely debt-free is not the main goal as debt can help fund investments or assets to improve your life while allowing you practice good payment behavior.

- Invest wisely. Investing can help grow your wealth over time, but it’s important to get into it with eyes wide open. Research different investment options, such as stocks, bonds, and mutual funds, and choose investments that align with your financial goals and risk tolerance.

- Benefit from the wisdom of others. Seek advice from a financial advisor or mentor who can provide guidance and support as you work towards your financial goals. You can also make use of online resources such as MortgageCalculator.org to deepen your knowledge about personal finance.

A fun way to sharpen your money smarts

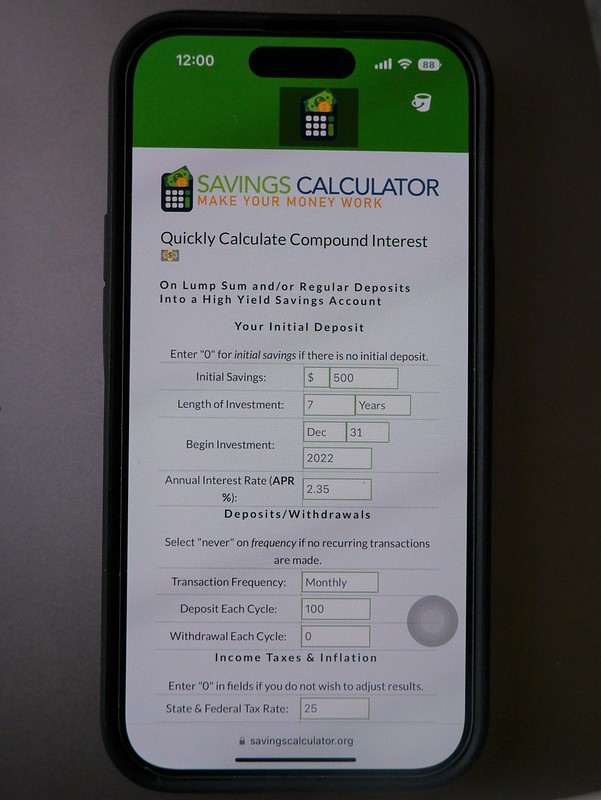

Aside from providing a range of educational resources on mortgages and home buying, MortgageCalculator.org also offers free and easy -to-use mortgage calculators to help users calculate various aspects of their mortgage payments and, ultimately, their financial health.

It also houses a variety of engaging and educational money games that can help users improve their money smarts and practice their financial decision-making using real-world scenarios. Over time, as users develop their financial acumen, they also develop their confidence to make sound financial decisions in real life.

Want to try your hand at honing your own money smarts through online games at MortgageCalculator.org? Check these out:

- Cashback: Give the correct change for each transaction by selecting the bills and coins needed to correctly sum to the customer’s change amount. This is perfect for teaching kids about the value of money (because they, too, need to develop money smarts!)

- Stocks: Ever wondered what it was like to be one of those day traders at Wall Street? This game simulates the up- and down-trends of the stock market while the player tries to buy low while selling high.

- Red Outpost: Colonize Mars by sending astronauts to harvest food and mine valuable goods. The game approximates the dynamics of building a new economy from the ground up.

- Coffee Shop: Build your coffee shop business by managing your inventory, cashflow, pricing and formula taking the fluctuations on the demand for coffee based on the weather. This teaches players to balance both internal and external factors in growing a business.

- Sort the Trash. Move the recycling bins across the screen to catch recyclables such as cans, cartons and bottles. This is a good approximation of the need to weed through all sorts of trash to get the items of value.

These are just a sampling of the games available at at MortgageCalculator.org. Browse through the various categories to find the games that can help you grow your knowledge and skills on financial matters while providing you with lots of fun!

By providing an engaging and interactive way to learn about business strategy and personal finance, these games make learning about money more accessible and fun, which you can then apply to your real-life money strategy.

No matter which stage in life you are right now, developing money smarts is the best way to take control of your finances to get you to achieve financial stability. Honing your financial literacy will help you make smart financial decisions to set you up in a good financial position for life. So take the time to learn about money and take full advantage of the resources available to sharpen your money smarts.